Taiwo Oyedele Explains Delay in Issuance of Tax Reform Guidelines

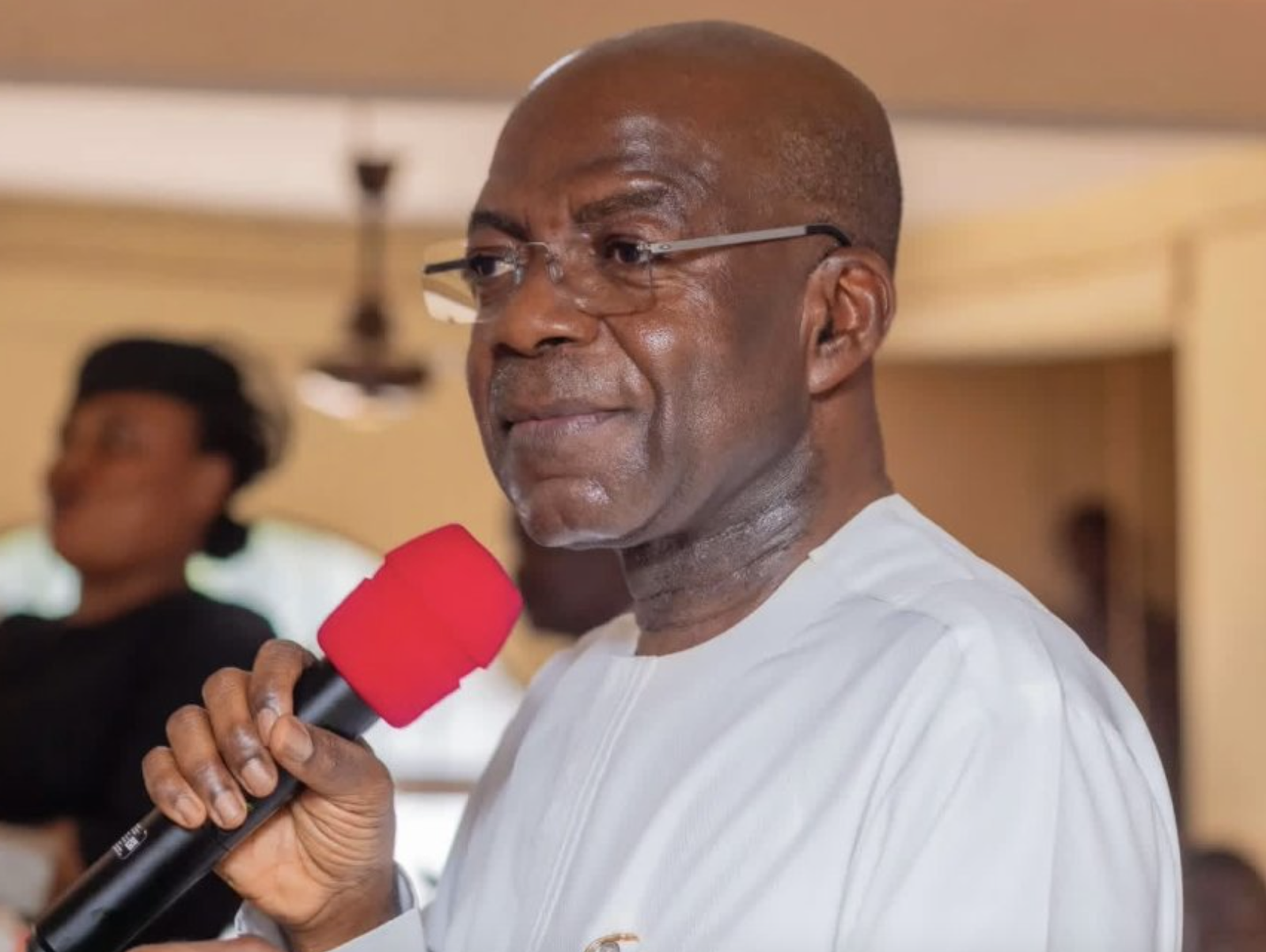

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has explained

the reason behind the delay in issuing implementation guidelines for Nigeria’s newly enacted tax laws.

Oyedele spoke on Wednesday in Lagos during the 2026 Economic Outlook event organised by the

Institute of Chartered Accountants of Nigeria (ICAN).

Addressing accountants, policymakers and business leaders, Oyedele said the delay is primarily due to

uncertainty over the final, officially authenticated version of the tax laws, a situation that has hindered

regulators from publishing detailed guidelines.

He said that although more than 40 regulations, guidelines and public notices have been finalised, they

cannot be issued because it is not yet clear which version of the laws is legally definitive under the Acts

Authentication Act.

According to Oyedele, the Nigerian Revenue Service (NRS) and the Joint Revenue Board (JRB) were

advised to wait before releasing any guidelines.

He explained that while a gazetted version of the laws was initially published and shared with the public,

some lawmakers contested that it did not reflect what was passed by the National Assembly, prompting

them to conduct their own review and produce alternative gazetted versions.

Oyedele noted that, under the Acts Authentication Act, only the officially published copies from the

Government Printer constitute legal evidence of the law passed, and until such copies are finally

authenticated and made available, regulators are unable to confidently issue guidance on

implementation.

“We can’t issue guidelines when we are not 100 per cent certain that this is the final official position,”

he said.

He recounted that his team was instructed to obtain printed copies from the Government Printer in

compliance with legal requirements, but was informed that the National Assembly had taken all printed

copies pending its review, thereby creating further uncertainty.

Oyedele characterised this as an understandable step by the legislature but acknowledged that it

complicates the timing of guideline issuance.

Oyedele also sought to reassure stakeholders that although discrepancies have arisen between versions,

the differences are limited and do not affect fundamental elements such as tax rates, tax authorities or

filing deadlines, emphasising that the core structure of the tax reforms remains intact.

The new tax laws, including the National Revenue Service Act, Nigeria Tax Administration Act, Nigeria

Tax Act and Joint Revenue Board Act, took effect on January 1, 2026 and are pivotal to the federal

government’s broader fiscal reform agenda.

While their implementation continues to attract intense public debate, Oyedele’s comments shed light

on procedural and legal safeguards influencing the pace at which detailed implementation instructions

are released.

Earlier reports suggesting the government had suspended guideline issuance were later labelled

misleading by some officials; however, Oyedele’s comments focused on the legal basis for holding back

the rollout pending authentication, not on a permanent halt.

By Oyinkansola Shittu.

QQ88 là nền tảng giải trí trực tuyến với casino, thể thao, nổ hũ, bắn cá đa dạng. Hệ thống ổn định, dễ chơi, ưu đãi hấp dẫn cho người tham gia.

QQ88 là nền tảng cá cược trực tuyến uy tín, tích hợp casino live, nổ hũ, bắn cá và thể thao với trải nghiệm ổn định.